Future Frontiers: Innovations in Smart Contracts

- Understanding Smart Contracts and Their Potential Impact

- Exploring the Evolution of Blockchain Technology

- The Role of Artificial Intelligence in Enhancing Smart Contracts

- Challenges and Opportunities in Implementing Smart Contracts

- Case Studies: Real-world Applications of Smart Contracts

- Regulatory Considerations for the Future of Smart Contracts

Understanding Smart Contracts and Their Potential Impact

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They run on blockchain technology and automatically enforce and execute the terms of the contract without the need for intermediaries. This automation can streamline processes, reduce costs, and increase trust between parties.

One of the key benefits of smart contracts is their potential to revolutionize industries by enabling secure, transparent, and efficient transactions. By removing the need for intermediaries, smart contracts can reduce the risk of fraud and manipulation, as well as eliminate the costs associated with traditional contract enforcement.

Smart contracts have the potential to impact various sectors, including finance, real estate, supply chain management, and more. For example, in the finance industry, smart contracts can facilitate instant and secure payments, automate compliance processes, and enable new financial products and services.

Overall, smart contracts have the potential to transform the way agreements are made and executed, offering a new level of security, efficiency, and trust in transactions. As this technology continues to evolve, it will be interesting to see the full extent of its impact on various industries and the global economy.

Exploring the Evolution of Blockchain Technology

Blockchain technology has come a long way since its inception with the creation of Bitcoin in 2009. It has evolved significantly, expanding beyond just cryptocurrencies to revolutionize various industries through the implementation of smart contracts. These self-executing contracts are stored on a decentralized blockchain network, ensuring transparency, security, and efficiency in transactions.

One of the key advancements in blockchain technology is the development of Ethereum in 2015, which introduced the concept of smart contracts to the mainstream. This platform enabled developers to create decentralized applications (dApps) that run on the blockchain, further expanding the possibilities of what blockchain technology can achieve.

As blockchain technology continues to evolve, we are seeing more innovations in the space of smart contracts. New platforms are emerging, offering improved scalability, interoperability, and security features. These advancements are driving the adoption of smart contracts across various industries, from finance and supply chain management to healthcare and real estate.

The future of blockchain technology and smart contracts holds great promise. With ongoing research and development, we can expect to see even more sophisticated applications of smart contracts, enabling automated and secure transactions without the need for intermediaries. This will not only streamline processes but also reduce costs and minimize the potential for fraud or error.

In conclusion, the evolution of blockchain technology and smart contracts is paving the way for a more decentralized and efficient future. By exploring the latest innovations in this space, we can unlock new possibilities for how we conduct transactions and interact with each other in the digital age.

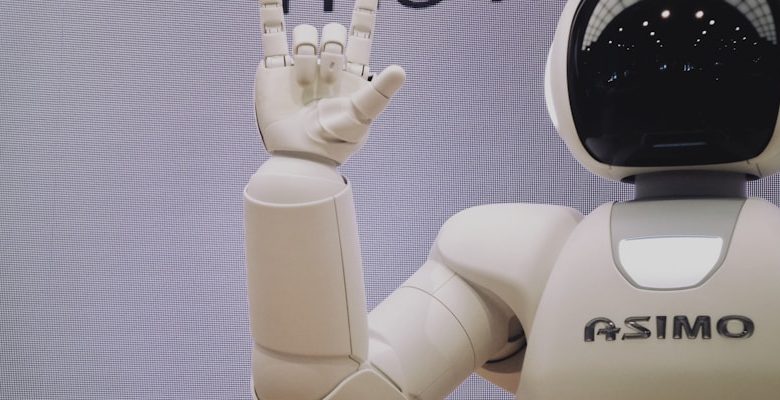

The Role of Artificial Intelligence in Enhancing Smart Contracts

The integration of artificial intelligence technology into smart contracts has revolutionized the way contracts are executed and enforced. AI algorithms are capable of analyzing vast amounts of data to identify patterns, predict outcomes, and optimize contract terms. By leveraging AI, smart contracts can automatically adjust to changing conditions, reducing the need for manual intervention and streamlining the contract management process.

One of the key benefits of using AI in smart contracts is the ability to enhance security. AI algorithms can detect and prevent potential security breaches by continuously monitoring for suspicious activities and anomalies. This proactive approach to security helps mitigate risks and ensures that smart contracts remain secure and tamper-proof.

Moreover, AI-powered smart contracts can improve efficiency by automating routine tasks and decision-making processes. By using AI to analyze data and make real-time decisions, smart contracts can execute transactions faster and more accurately. This not only saves time but also reduces the likelihood of errors and disputes, leading to smoother contract execution.

In addition to security and efficiency improvements, AI can also enhance the intelligence of smart contracts. By incorporating machine learning algorithms, smart contracts can learn from past interactions and optimize their performance over time. This adaptive capability allows smart contracts to evolve and adapt to changing circumstances, making them more dynamic and responsive.

Overall, the role of artificial intelligence in enhancing smart contracts is crucial for unlocking their full potential. By combining the power of AI with smart contract technology, businesses can create more secure, efficient, and intelligent contracts that drive innovation and growth. As AI continues to advance, the possibilities for smart contracts are limitless, paving the way for a future where contracts are more reliable, transparent, and adaptable.

Challenges and Opportunities in Implementing Smart Contracts

Implementing smart contracts presents both challenges and opportunities for businesses looking to streamline their operations and increase efficiency. One of the main challenges is the complexity of coding these contracts correctly to ensure they execute as intended. This requires a high level of technical expertise and attention to detail.

Another challenge is the need to ensure that smart contracts are legally binding and enforceable. This requires careful consideration of the legal framework in which the contracts operate and may involve working closely with legal experts to ensure compliance.

Despite these challenges, there are also significant opportunities for businesses that successfully implement smart contracts. These contracts can automate many processes that are currently manual, saving time and reducing the risk of errors. They can also enable new business models and revenue streams by facilitating transactions that were previously too complex or costly to execute.

Furthermore, smart contracts can increase transparency and trust in business transactions by providing a secure and immutable record of all interactions. This can help to reduce disputes and streamline dispute resolution processes, saving businesses time and money.

Case Studies: Real-world Applications of Smart Contracts

Smart contracts have been implemented in various real-world scenarios, showcasing their versatility and potential. Here are some case studies that demonstrate the practical applications of smart contracts:

- Supply Chain Management: Smart contracts are being used to streamline supply chain processes by automating tasks such as tracking inventory, verifying authenticity, and executing payments. This helps in reducing errors, improving transparency, and enhancing efficiency in the supply chain.

- Real Estate Transactions: Smart contracts are revolutionizing the real estate industry by digitizing property ownership, automating property transfers, and ensuring compliance with regulations. This not only speeds up the transaction process but also reduces the need for intermediaries.

- Insurance Claims Processing: Smart contracts are being utilized in insurance companies to automate the claims process, verify claims data, and execute payouts. This leads to faster claim settlements, reduced fraud, and increased trust between insurers and policyholders.

- Cross-Border Payments: Smart contracts are facilitating cross-border payments by enabling instant, secure, and cost-effective transactions between parties in different countries. This eliminates the need for traditional banking intermediaries and reduces transaction fees.

- Tokenization of Assets: Smart contracts are enabling the tokenization of assets such as real estate, art, and commodities. This allows for fractional ownership, increased liquidity, and easier transfer of assets, opening up new investment opportunities for individuals and institutions.

Regulatory Considerations for the Future of Smart Contracts

When considering the future of smart contracts, it is crucial to take into account the regulatory landscape that governs these innovative digital agreements. As smart contracts continue to gain popularity and use across various industries, regulators are grappling with how to adapt existing laws to accommodate this new technology. Issues such as contract enforcement, data privacy, and jurisdictional concerns are at the forefront of regulatory considerations for smart contracts.

One of the key challenges facing regulators is determining how traditional contract law principles apply to smart contracts. The nature of smart contracts, which are self-executing and automated, raises questions about how to interpret and enforce these agreements in the event of disputes. Additionally, concerns about data privacy and security have led to calls for increased regulation to protect sensitive information stored on blockchain networks.

Another important consideration for the future of smart contracts is the question of jurisdiction. With smart contracts operating on decentralized blockchain platforms, it can be difficult to determine which laws and regulations apply to these agreements. Regulators are faced with the task of creating a framework that can effectively govern smart contracts while also allowing for innovation and growth in this rapidly evolving field.